New tax rules for gambling in Armenia

The gambling industry in Armenia has seen a dramatic rise. In 2010, the turnover of online gambling stood at 14 billion drams (approximately $35 million), but by 2023, it had surged to 6.3 trillion drams ($15.8 billion), increasing more than 440 times. However, tax revenues from this sector have only grown 26 times over the same period, creating a significant imbalance between gambling business profits and state budget contributions.

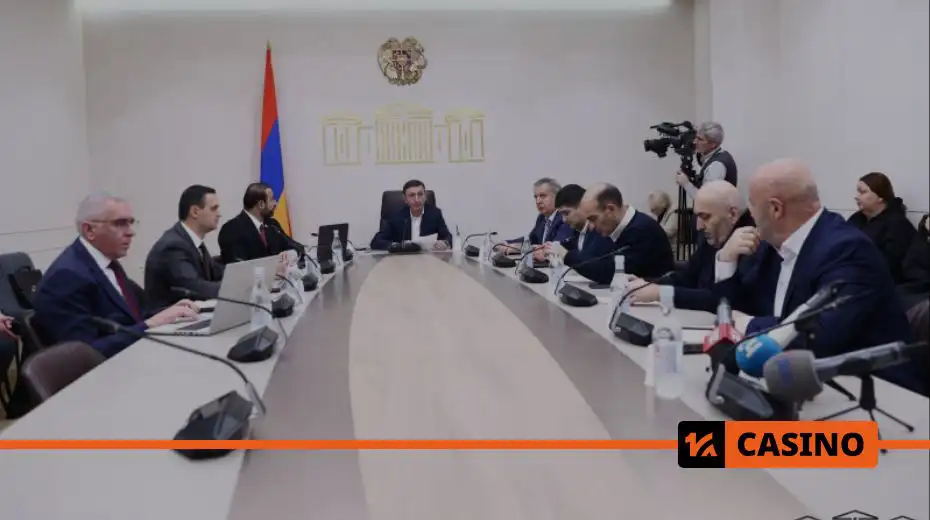

At the meeting of the Standing Committee on Economic Affairs, a bill proposing amendments to the Tax Code was discussed. Its main provision is the introduction of a new 10% turnover tax for gambling businesses, including:

- Online gambling

- Virtual gambling

- Lotteries

- Betting

- Online betting operations

The bill’s author emphasized that previous measures to regulate the industry and increase taxation have not been sufficient, as statistics reveal the sector’s continued rapid expansion.

“The goal of this proposal is to maintain current gambling volumes while generating an additional 100 billion drams in annual tax revenue for the state budget,” Sargsyan stated.

Government stance and Parliamentary debate

The Armenian Ministry of Finance does not support the initiative, arguing that increasing gambling taxes is not a feasible solution. However, the bill has already received preliminary approval from the government.

During the discussions, lawmakers expressed concerns over the industry’s expansion and stressed the need for a thorough analysis of the consequences of increased taxation. Proposals were made to introduce additional monitoring and regulatory tools.

Key arguments in favor of the bill:

- The rapid growth of the gambling sector requires stricter tax control.

- Increased taxation could generate an extra 100 billion drams annually.

- It would help mitigate the social and economic risks associated with gambling.

Arguments against the bill:

- A sharp tax increase could drive the industry underground.

- Industry representatives must be consulted before making drastic changes.

- The government has not yet issued an official statement on the proposal.

Deputy Minister of Finance A. Poghosyan clarified that the government has not yet taken a final stance on the proposed changes.

Committee’s decision: further discussions required

During the debate, lawmakers suggested postponing the bill’s consideration for two months. During this period, further consultations with gambling industry representatives will be held, and the government’s official position will be determined.

“This is a highly sensitive topic. A thorough discussion with industry stakeholders is necessary before making any final decisions,” noted Deputy Chairman of the Committee B. Tunyan.

As a result, a decision was made to organize working discussions with representatives of the four largest gambling companies. There is also a possibility that industry leaders may propose raising the turnover tax above 10%.

Conclusion

Armenia faces a critical decision: to increase tax pressure on its rapidly expanding gambling sector or to explore alternative regulatory mechanisms. The proposed 10% turnover tax could generate significant revenue for the state but may also provoke backlash from industry operators.

At this stage, the bill requires further discussion and industry consultation to minimize potential negative consequences. A final decision will be made after additional analysis and negotiations within the next two months.

Comments

No comments yet