Betting on Counter-Strike and Valorant is increasing, while Dota 2 is declining: esports betting monitoring 2024

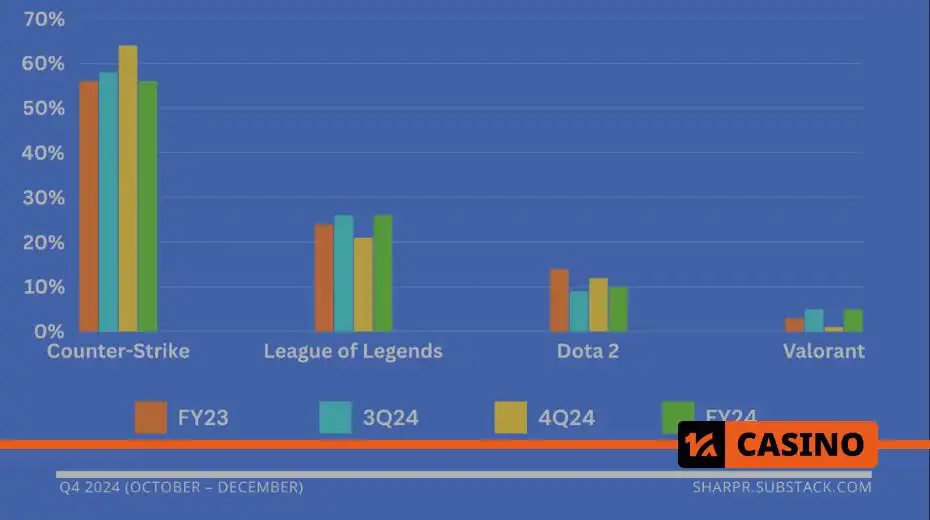

In 2024, Valorant’s share of esports betting volume increased from 3% to 5%, while Counter-Strike peaked in the fourth quarter, accounting for 64% of the total betting volume. Generation Z players surpassed millennials, making up 44% of all esports bets. Key events in the fourth quarter included the Shanghai Major for Counter-Strike and the League of Legends World Championship. Interest in Dota 2 continues to decline, whereas Valorant is gaining popularity. Betting on eSports is now available at almost any bookmaker or multifunctional platforms with online casinos, sports betting, poker and other gambling games.

The rise of Valorant

Valorant, Riot Games’ first-person shooter, is steadily growing in the esports betting industry. In 2024, its share of total betting volume nearly doubled, increasing from 3% to 5%. This growth is driven by Riot Games’ successful marketing strategy and increasing interest from a younger audience.

Key reasons for Valorant’s growth:

- Regular hosting of major tournaments such as the Valorant Champions Tour (VCT).

- Fast-paced gameplay, making it ideal for live betting.

- Active developer support, including updates and new content releases.

“Valorant is becoming a new favorite among esports disciplines. Its growth is the result of Riot Games’ smart strategy and the interest of the younger generation,” analysts note.

Comparing Valorant with other disciplines, Counter-Strike remains the leader, gathering 64% of bets in the fourth quarter. However, Valorant is steadily strengthening its position, making it one of the most promising esports markets.

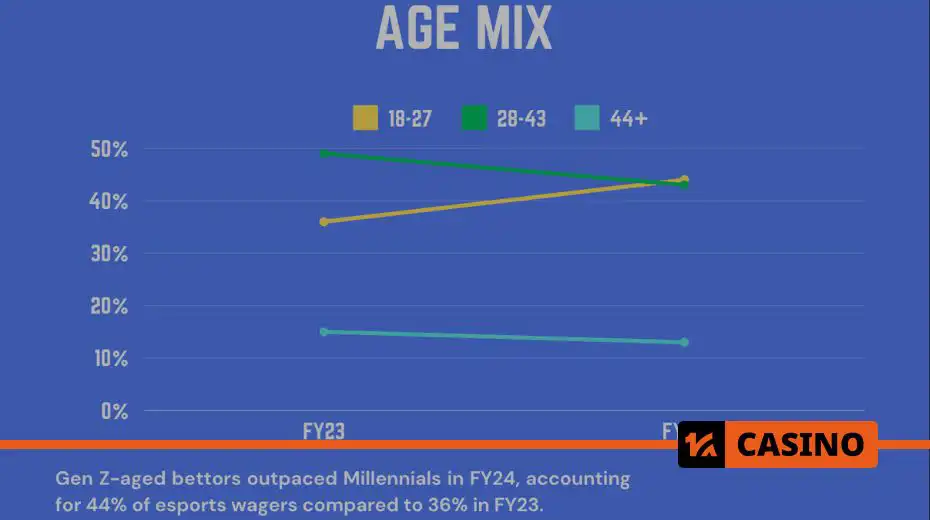

Generation Z as the key audience

Demographic analysis shows that Generation Z (born after 1997) is becoming the core audience for esports betting. In 2024, they accounted for 44% of all bets, surpassing millennials (36%). Together, these two age groups covered 87% of the market, emphasizing their significance for the industry.

Generation Z characteristics:

- Highly engaged in the digital environment.

- Preference for interactive entertainment such as streaming and esports.

- Active use of mobile devices for betting and watching tournaments.

The average age of bettors on Counter-Strike is 31, while for League of Legends, it’s 29, as LoL attracts a younger audience, especially during major tournaments like the World Championship.

“Generation Z is the future of esports. Their habits and preferences shape the new trends we see today,” experts comment.

Popularity of prop bets and live betting

Prop bets, such as “total kills by a player,” are gaining popularity among Counter-Strike fans. In Q4, they accounted for 13% of all bets in this discipline. Live betting also remains in high demand, making up 46% of the total Counter-Strike betting volume.

Advantages of prop bets and live betting:

- Increase audience engagement.

- Add an element of excitement and interactivity.

- Allow betting on specific match events.

In comparison, live bets in Valorant accounted for only 28%, likely due to the smaller number of major tournaments and less developed live betting infrastructure. However, with the game’s rising popularity and the expansion of esports events, this figure is expected to grow significantly in the coming years.

“Live betting is not just a trend, it’s a new way to interact with the audience. It makes watching tournaments even more exciting,” specialists note.

Key events of Q4

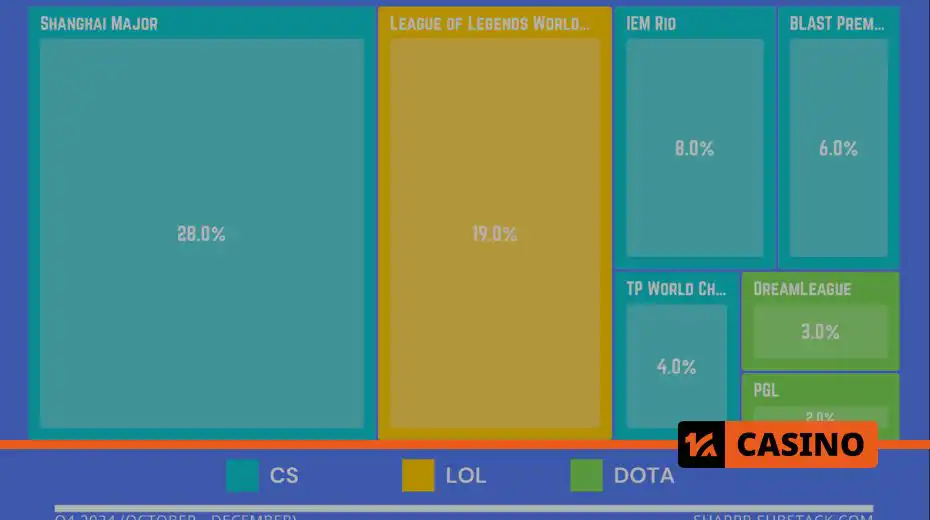

The Shanghai Major for Counter-Strike became one of the most significant events of Q4, gathering 28% of all bets. The League of Legends World Championship also showed growth, attracting 19% of bets, up from 15% in Q4 2023.

Top 3 Esports Events in Q4:

- Shanghai Major (Counter-Strike) – 28% of bets.

- League of Legends World Championship – 19% of bets.

- Dota 2 Tournaments (DreamLeague & PGL Wallachia) – 5% of bets.

Dota 2 tournaments, such as DreamLeague and PGL Wallachia, made it into the top 10 most popular events, but their share in total betting volume was only 5%, highlighting the continued decline in Dota 2’s popularity.

“Major tournaments drive the industry. They attract millions of viewers and create a favorable environment for betting,” analysts emphasize.

Industry trends

Riot Games and gambling

Riot Games, the publisher of League of Legends and Valorant, is beginning to show interest in gambling. In Q4, the company announced that partner teams are now allowed to sign deals with approved betting brands. This move could increase sponsorship revenue for esports teams and boost betting activity on Riot Games’ titles.

Implications of this decision:

- Higher sponsorship revenues for teams.

- Increased betting popularity on League of Legends and Valorant.

- Stronger competition among betting companies.

“This move by Riot Games could be a game-changer for the industry. It opens new opportunities for monetization and investment,” experts comment.

Declining interest in Dota 2

Dota 2 continues to lose popularity. The game’s biggest event, The International, attracted only 3% of bets in Q4. Since 2021, the tournament’s viewership has dropped by nearly 50%, and the prize pool has fallen from $40 million to $2.5 million. These trends indicate declining interest from both viewers and investors.

Reasons for Dota 2’s decline:

- Competition from other titles, such as Valorant and League of Legends.

- High complexity, making it hard for new players to enter.

- Reduced prize pools and declining viewer engagement.

“Dota 2 is losing its position, and this is a worrying signal for the industry. New approaches are needed to regain audience interest,” specialists note.

The future of esports betting

The esports betting industry continues to evolve, revealing new trends and shifts in audience preferences. Valorant and Counter-Strike remain key disciplines, attracting both players and bookmakers. Generation Z is becoming the primary audience, forcing the industry to adapt to their needs and interests.

Key Future Trends:

- Growth of live betting and prop bets.

- Increase in mobile betting platforms.

- Development of technologies such as AI and blockchain to enhance transparency and security.

Conclusion

Esports is solidifying its position as one of the fastest-growing entertainment industries. Esports betting is gaining traction, attracting new audiences and creating business opportunities.

Valorant, Counter-Strike, and League of Legends remain market leaders, while Dota 2 continues to decline. Generation Z is shaping the industry, requiring new approaches and innovations.

“Esports is not just about games; it’s an entire ecosystem that continues to evolve and surprise. Esports betting is a natural extension of this evolution,” experts conclude.

In the coming years, we can expect further industry growth, the emergence of new disciplines and betting formats, and intensified competition between developers and operators. Esports continues to inspire, and betting is becoming an integral part of this exciting world.

Source: Sharpr

Comments

No comments yet