State of the iGaming market in Brazil at the beginning of 2025

Brazil, a country with a population of 220 million people, 170 million of whom have internet access, represents a significant market for the iGaming industry. Football is an integral part of the country’s culture, contributing to the popularity of sports betting and other forms of online gambling.

According to Blask data, in January 2025, the Brazilian iGaming market faced a series of changes, including declining activity and the redistribution of market shares among operators.

Analysis of current trends

Reasons for the Blask Index decline

In January 2025, the Blask Index, which reflects player interest in online gambling, dropped from 196 million in December 2024 to 167 million, a 15% decrease. A similar decline has been observed in previous years, which may be linked to several factors:

- Seasonality – January traditionally sees a decline in player interest after the holiday season.

- Regulation – New licensing requirements forced operators to adjust their marketing and advertising strategies.

- Changes in player behavior – Following the holiday betting surge, many players take a break, temporarily reducing overall activity.

However, it is expected that figures will begin to recover in February and March.

Impact of licensing

As of January 1, 2025, mandatory licensing for iGaming operators was introduced in Brazil. This change led to:

- Increased costs for operators, affecting their marketing budgets.

- The exit of several small companies from the market that failed to adapt to the new requirements.

- Intensified competition among the remaining operators, impacting their advertising strategies.

In the long run, licensing may lead to a more transparent and sustainable market environment.

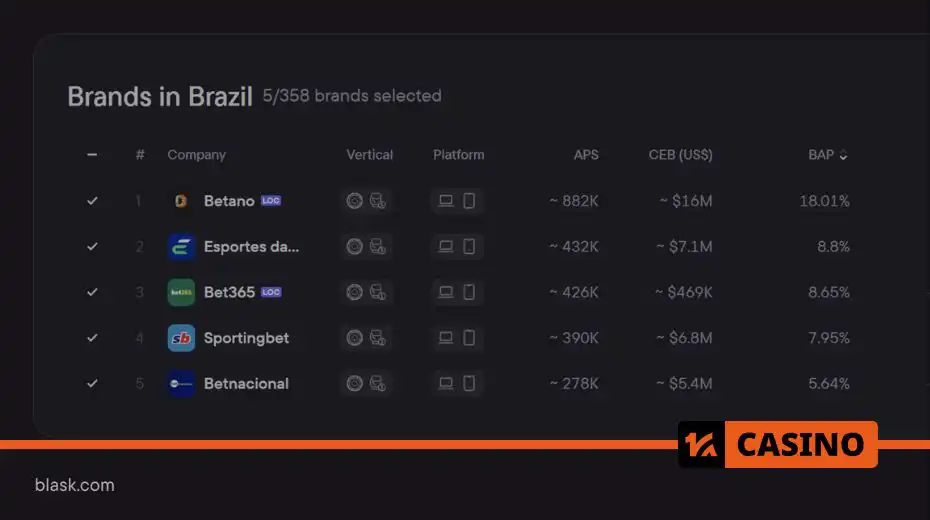

iGaming brand positions in Brazil

Market leaders and losers

Most leading iGaming brands in Brazil experienced a market share decline ranging from 3% to 20%. The exception was Esportes da Sorte, which increased its market share by 12%.

Market Share Changes Among Leading Brands:

| Operator | Market Share Change |

| Esportes da Sorte | +12% |

| Betano | -8% |

| Bet365 | -5% |

| Sportingbet | -7% |

| Blaze | -20% |

Factors contributing to Esportes da Sorte’s success:

- Aggressive marketing campaigns.

- Sponsorship of sporting events.

- Adaptation to new regulatory requirements.

Companies experiencing declines may have made the following mistakes:

- Insufficient preparation for new regulations.

- Reduced advertising investments.

- Weak adaptation to local player behavior.

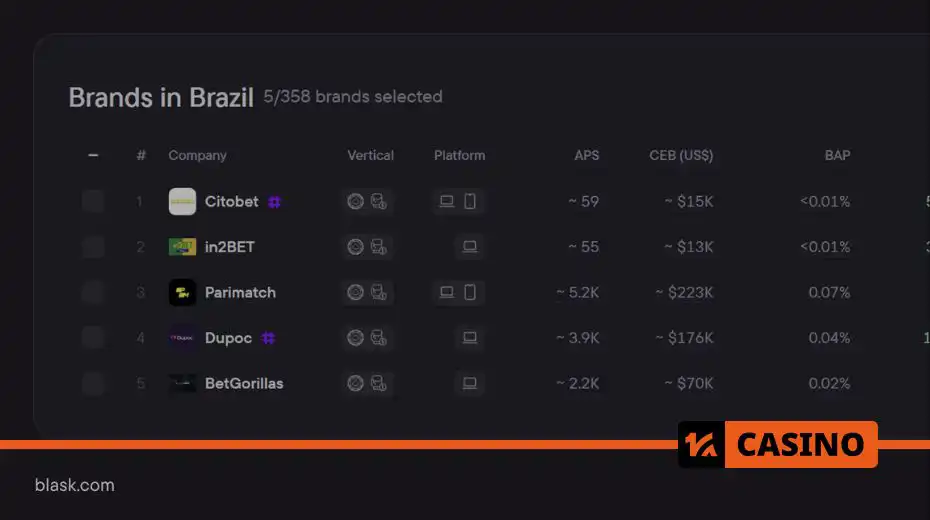

Fast-growing brands

Despite the overall market decline, some brands are demonstrating rapid growth. For example:

- MC Games: +111% growth.

- R7.bet: +101% growth.

These companies continue to expand their market share by actively building brand recognition and improving player offerings.

Forecasts and future prospects

Despite the decline in activity in January 2025, the Brazilian iGaming market retains strong growth potential.

Expected Trends in 2025:

- Growth of mobile gambling – Players are shifting to mobile platforms, driving the development of more user-friendly apps.

- Expansion of the legal market – Licensing will attract more official operators.

- Increased interest in alternative games – The popularity of casino games continues to rise alongside sports betting.

“The January decline in activity is a temporary phenomenon linked to adaptation to new conditions. Operators who quickly adjust will strengthen their market positions in 2025.”

The Brazilian iGaming market is undergoing a period of transformation, and the coming months will be crucial in determining its future development.

Source: Blask

Comments

No comments yet