Discover the fastest-growing iGaming markets of 2024

The iGaming industry continues to amaze with its rapid growth. In 2024, several countries demonstrated remarkable results, drawing the attention of players, operators, and investors alike. Analysts at Blask have identified five markets that have shown the most significant increase in interest in online gambling. This data is based on the Blask Index, a unique tool that tracks player activity in real-time. Which countries have topped the rankings, and what makes them so attractive for the iGaming business? Let’s dive in.

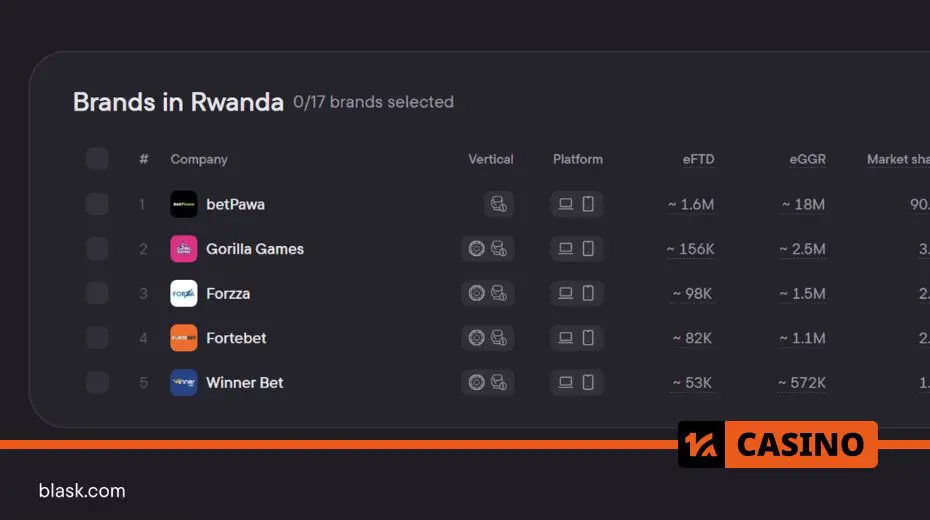

Rwanda: the new iGaming leader

Rwanda topped the list with a growth rate of 146.16%. This small East African country is rapidly developing, attracting investments and adopting innovations. The largest market share is held by betPawa, occupying 90.15%. However, despite the dominance of a single company, emerging brands like Winner Bet are showing impressive results. For example, in 2024, Winner Bet increased its market volume by 953%, though its market share remains modest.

Key player characteristics:

- 35% are aged 18–24.

- 70% prefer sports betting.

- 60% place bets to earn money.

- Only 5% of players are considered problematic.

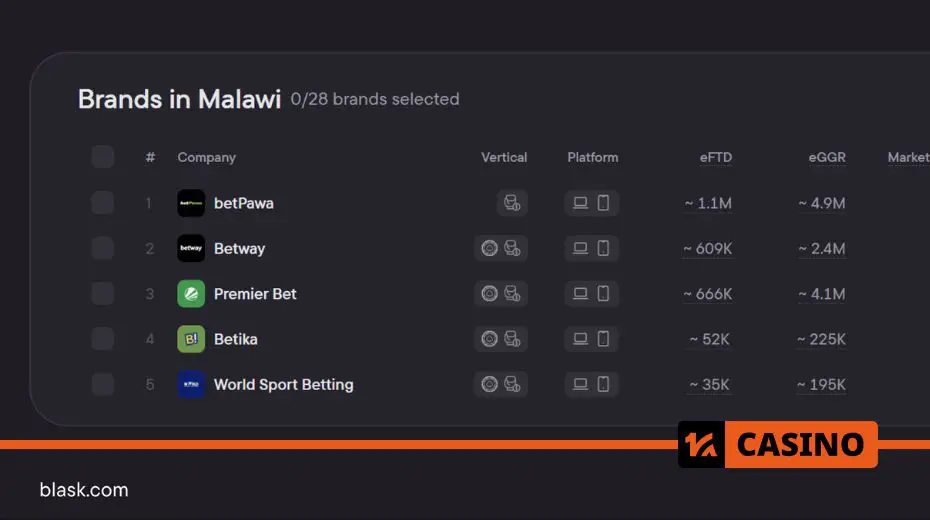

Malawi: consistent growth

Malawi, with a population of 22 million, ranked second with a growth rate of 116.53%. Here, betPawa dominates with a market share of 51.23%. However, the growth leader is Betway, which saw a 736% increase.

Player demographics:

- 40% of players are aged 25–34.

- 80% are interested in sports betting.

- Half of the users choose online gambling for its convenience.

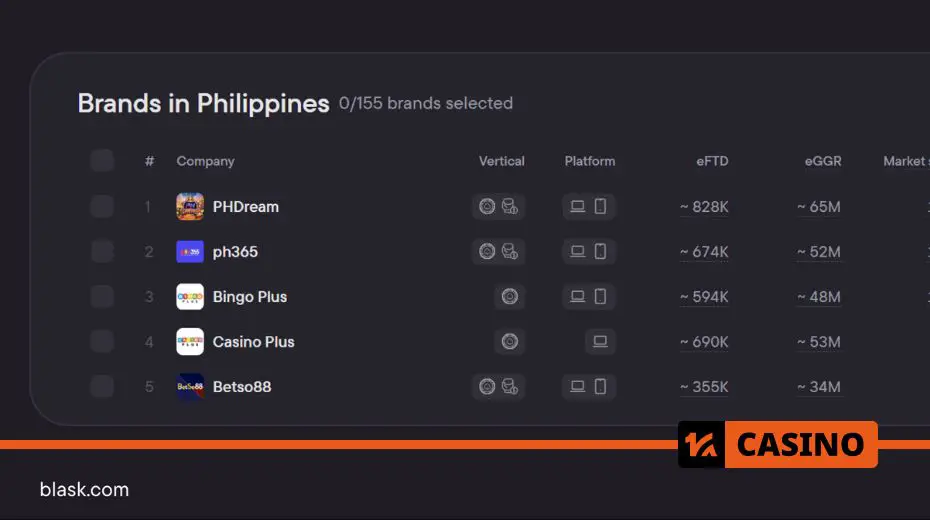

The Philippines: an unexpected leader

Among African countries, the Philippines stands out, taking third place with a growth rate of 113.18%. Interestingly, there are 155 brands operating here, with PHDream holding the largest market share at 17.06%. Nevertheless, the highest growth rates are demonstrated by smaller companies like IB8 (+3000%).

Player characteristics:

- 35% are aged 25–34.

- 60% play to earn money, while 40% play for the thrill.

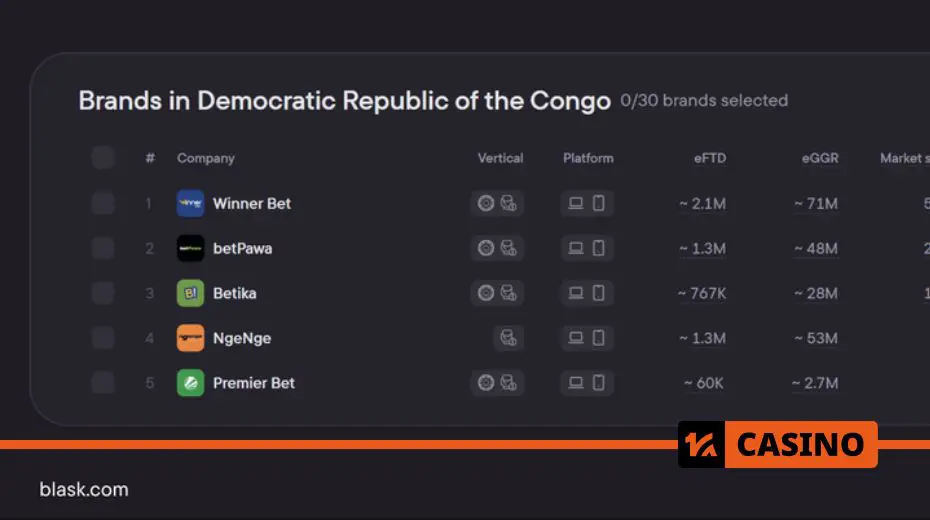

Democratic Republic of the Congo: potential for expansion

The DRC ranks fourth with a growth rate of 99.21%. Market leaders here are Winner Bet (54.44%) and betPawa (22.57%).

Key statistics:

- 35% of players are aged 18–24.

- 70% are interested in sports betting.

- Problematic gamblers account for 15%.

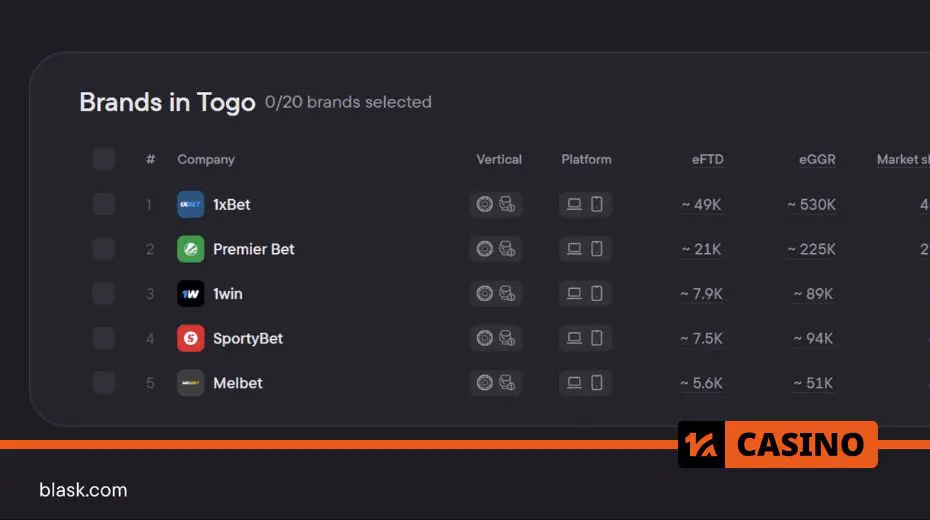

Togo: closing the top five

In Togo, where the market grew by 95.94%, the leading operator is 1xBet, holding a 45.54% share. Interestingly, Melbet showed a 1000% growth rate, increasing its share to 6.19%.

Key features:

- 40% of players are aged 25–34.

- 55% participate in online lotteries.

Conclusion

2024 was a breakthrough year for iGaming, particularly in African countries. Growth leaders like Rwanda and Malawi demonstrate immense potential for operators and investors. These markets show that a combination of modern technologies, user convenience, and high interest in sports betting creates favorable conditions for the industry’s development. Now is the perfect time to secure a position in these regions and seize new opportunities.

Comments

No comments yet