Top 10 iGaming brands in the world in January 2025

The iGaming market is rapidly evolving, and the industry leaders are constantly changing. Here is an analysis of the top 10 brands (online casinos) by three key indicators: revenue, number of new players, and global presence. Some giants have maintained their positions, while new contenders have broken into the rankings.

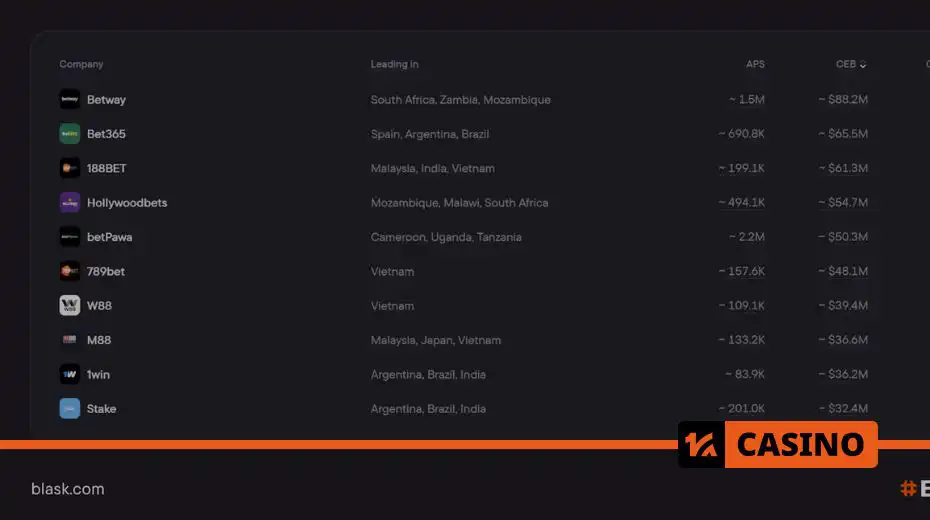

Top 10 iGaming brands by revenue (January 2025)

The Competitive Earning Baseline (CEB) metric predicts a company’s potential revenue based on market trends and consumer behavior analysis.

| Brand | Revenue (million $) |

| Betway | 88.2 |

| Bet365 | 65.5 |

| 188BET | 61.3 |

| Hollywoodbets | 54.7 |

| betPawa | 50.3 |

| 789bet | 48.1 |

| W88 | 39.4 |

| M88 | 36.6 |

| 1win | 36.2 |

| Stake | 32.4 |

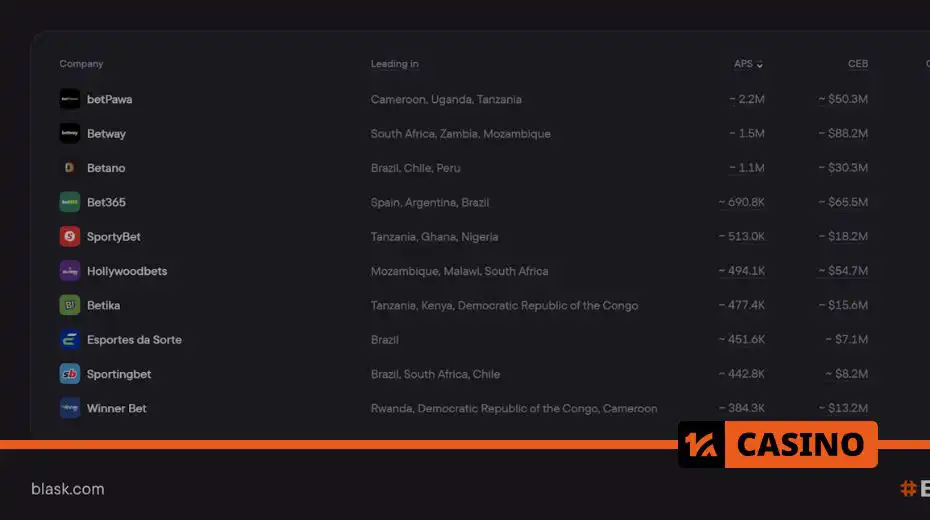

Top 10 by new player acquisition (APS)

The Acquisition Power Score (APS) measures how effectively brands convert their marketing efforts into real customers.

| Brand | New Players (million) |

| betPawa | 2.2 |

| Betway | 1.5 |

| Betano | 1.1 |

| Bet365 | 0.69 |

| SportyBet | 0.51 |

| Hollywoodbets | 0.49 |

| Betika | 0.48 |

| Esportes da Sorte | 0.45 |

| Sportingbet | 0.44 |

| Winner Bet | 0.38 |

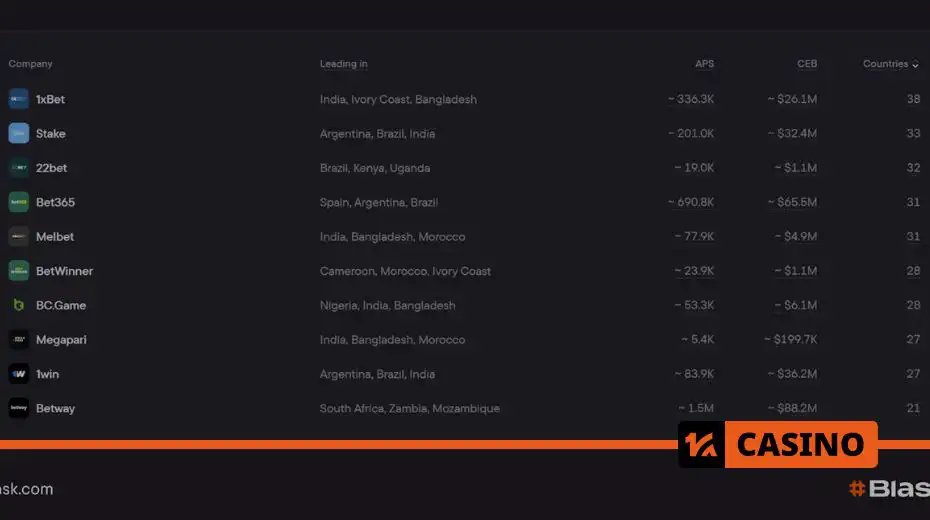

Top 10 by number of countries present

Some brands focus on global expansion, but that doesn’t always correlate with revenue and player growth.

| Brand | Number of Countries |

| 1xBet | 38 |

| Stake | 33 |

| 22bet | 32 |

| Bet365 | 31 |

| Melbet | 31 |

| BetWinner | 28 |

| BC.Game | 28 |

| Megapari | 27 |

| 1win | 27 |

| Betway | 21 |

What really matters?

The common assumption is that the more countries a brand covers, the higher its revenue and audience. However, reality tells a different story.

“It’s better to be first in a village than second in Rome.”

A great example is 789bet, which earns almost half the revenue of Betway but operates in just one market. Similarly, Esportes da Sorte and Betika attracted a nearly identical number of new players, but Esportes da Sorte did it in one country, while Betika had to operate in 13.

Another key comparison is Melbet vs. Bet365. Both operate in 31 countries, yet Bet365 outperforms Melbet by 9 times in new player acquisition and 13 times in revenue.

Long-Term trends in iGaming

The gambling industry is constantly changing, and successful brands adapt to new challenges. Beyond revenue, reach, and player acquisition, long-term strategies are crucial.

- Technological Innovation: AI-driven personalization and advanced analytics help brands predict player behavior more accurately.

- Localization: It’s not just about being in multiple countries but adapting to local preferences—languages, payment methods, and marketing approaches.

- Regulatory Flexibility: Market leaders actively work with regulators, ensuring compliance and securing licenses in key regions.

- Marketing & Partnerships: Sponsorship deals, influencer collaborations, and esports integrations help brands reach new audiences.

Conclusions

- A wide geographical reach does not guarantee high revenue or player numbers.

- Strong regional brands can generate just as much revenue as global giants.

- Strategy matters more than scale—focusing on one market can be more effective than spreading across multiple regions.

- iGaming leaders must prioritize not only expansion but also enhancing player engagement and trust.

- Companies investing in innovation, personalization, and regulatory adaptation will dominate in the long run.

The market is constantly evolving, and the race for leadership continues. Which brands will stay on top next month? Time will tell.

Source: BLASK

Comments

No comments yet